Conflicts In Families – The Stronach Family

With a considerable run of highly public rifts within family-run businesses over the past few years, David Bentall, author of Leaving a Legacy: Navigating Family Businesses Succession, is especially skilled to share his perspective and advice on the tipping points and best practices for building a successful family- business partnership.

Have you ever asked yourself what it would be like to come to a new country, with little or no knowledge of the language, no family, no job prospects, and enough money to keep you afloat for only a few weeks? And, at times, having to make a choice as to whether you would use that money for food or drop that coin in the bus to look for a job?

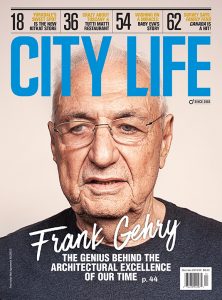

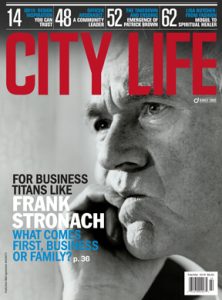

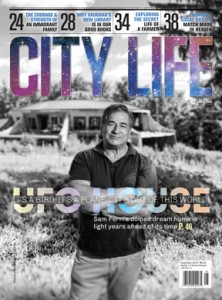

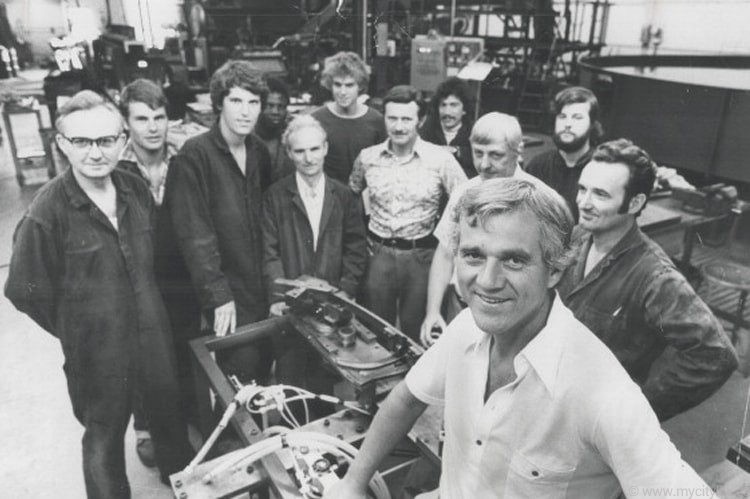

In 2019, Canada is a country that is both welcoming and culturally aware, with a host of educational and social programs to help new immigrants. However, in the early to mid-20th century, when immigrants like Frank Stronach and Sam Sorbara came to Canada, Canadians did not realize or truly recognize the valuable contribution that men such as Stronach, who came from Austria to Canada in the 1950s, or Sorbara, who came in the 1920s from Italy, would contribute to the overall innovation, entrepreneurial spirit and mosaic of Canada.

As these new Canadian families put down roots, they flourished and began to have families. Many of the entrepreneurial elders who headed up the corporations that they had founded, nurtured and groomed their children to become part of the family business. There is an unspoken understanding that family members are inherently loyal, with a vested interest to protect the family’s entreprise — the blood, sweat and tears that went into it when their grandfather or father founded the companies in which they work and hold increasingly senior positions of power. There is also an emotional attachment in a family-run business that extends beyond the business itself. The next generation wants to prove themselves, to make their elders proud and, of course, to position themselves as the right person to take over the family business.

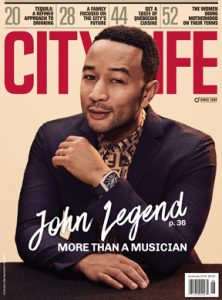

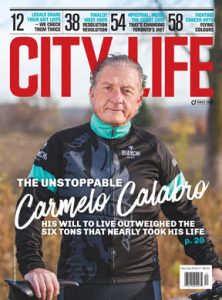

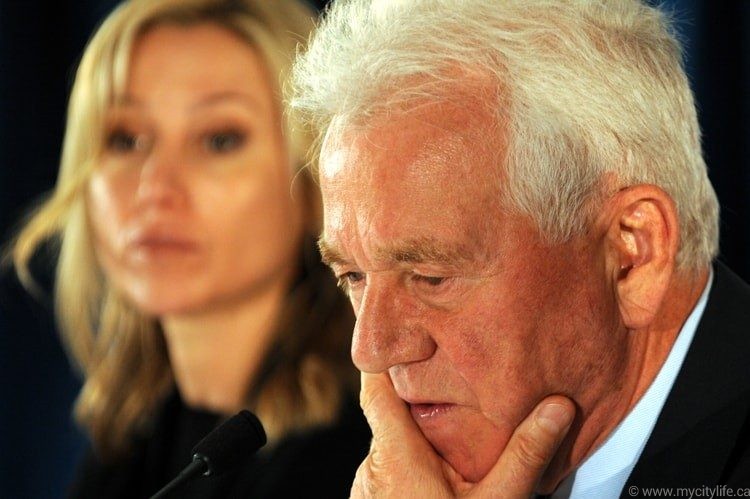

And therein lies the crux of the power issues in the families you are about to meet. Frank Stronach, 86, the patriarch of the Stronach family, came to Canada from Austria as a struggling tool-and-die maker in 1954. He went on to become the chairman and CEO of Magna International Inc., an international automotive supplier that became the largest auto parts manufacturer in North America. His wealth portfolio grew from there (Frank is listed as No. 31 on the Canadian Business 2017 list of the country’s richest people, valued at $3.06 billion), and it now includes a corporate jet, the 420-acre Adena Golf and Country Club in Florida and Adena Farms.

Frank’s investment in Adena Farms — an agricultural grass-fed cattle farm and production facility that changes the way people eat, coupled with an organic food company that supports retail storefronts — was to be Frank’s legacy. (Ironically, Frank is pretty much a vegetarian.) A passionate horse lover and racing aficionado, Frank has won the Queen’s Plate four times (2017, 2015, 1997, 1994); the Belmont Stakes in 1997; and the Preakness Stakes in 2000. In fact, he is the largest owner and operator of thoroughbred racetracks in North America, with tracks in Santa Anita Park, Calif.; Gulfstream Park, Hallandale Beach, Fla.; and Pimlico Race Course (home to the renowned Preakness Stakes), Baltimore, Frank’s racing and gaming assets now count as one of the Stronach Group’s (TSG) core businesses.

From day one, Frank’s pre-eminent philosophy has always been “family first.” Under his oversight, the 445327 Trust (known as the Stronach 445 Family Trust) was established for his daughter Belinda and her two children, Nicole (Nikki) and Frank (Frankie) Walker (Belinda 445 Trust); Belinda’s brother Andrew and his daughter, Selena (Andrew 445 Trust); and Frank’s wife, Elfriede (beneficiary of the 445327 Trust).

“Some of the tipping points that may trigger a generational rift include the common language we use when we think about family enterprises”— David Bentall

In 2013, when Stronach ran for government in Austria, he resigned as trustee of the 445 Trust, appointing Belinda’s two children as temporary trustees in his absence. In the 73-page lawsuit filed in court on Oct. 1, 2018, Frank and Elfriede are suing Belinda (who is the current chairman and president of TSG), grandchildren Nicole and Frankie, as well as Alon Ossip, CEO of TSG, demanding $520 million in damages and a full accounting of attributable monies. The lawsuit claims that Frank’s resignation was contingent upon each of the defendants honouring set-out commitments, and, most importantly, that Frank would retain de facto control of TSG. The lawsuit also posits that it was always clearly understood that Frank would resume his leadership role as super trustee (with Nicole and Frankie resigning) upon demand.

In true Shakespearean form (with a dash of Freud stirred in), what began as a father/daughter champion/hero relationship has flamed out spectacularly over power and money. Frank’s “family first” mantra has devolved into a dictionary of language that is at the complete opposite spectrum of support and nurture. Phrases and accusations contained in the father-against-daughter (not to mention grandchildren and Ossip) lawsuit include: willfully, covertly, oppressively, dismantled, prejudicially, unlawfully, abused positions of authority and overwhelming detriment. Of particular note is the statement that Belinda has “wielded inappropriately her relationship with her father,” and that “she had misled Frank into thinking that she could run the family enterprise, when in fact, she was unwilling or incapable of doing so.” Under Punitive Damages in the law suit, item No.167 of the lawsuit states that: “In all of the relevant circumstances, the conduct of Belinda and Alon is disgraceful, shocks the conscience of the Court, and warrants a substantial award of aggravated, exemplary or punitive damages.”

The long list of finger-pointing against Belinda also includes accusations around maintaining an extravagant lifestyle, to the tune of C$70 million, and that she has engaged in a series of self- dealing transactions, utilizing and diverting substantial finds and resources of TSG to favour her own business and personal interests at the expense of Frank, Elfriede and the family.

In a court filing on Jan. 21, 2019, Belinda responded to the lawsuit, alleging that her father, who she claims has “lost his entrepreneurial touch,” has also lost $800 million on several ill- advised ventures, which include two US$55-million bronze and steel sculptures of the winged horse Pegasus. Countersuing her father for $32.8 million, Belinda is asking that she be left in charge of The Stronach Group, with its six American horse-racing tracks, gambling and media businesses based on thoroughbred racing and real estate.

Her cross-the-bow response to the initial lawsuit filing is: “Family relationships within a business can be challenging. My children and I love my father. However, his allegations are untrue and we will be responding formally to the statement of claim in the normal course of the court process.”

How is that for setting the table for a Sunday family dinner?

But for those of us on the outside looking in, the question of why Frank, at 86, would want to alienate his family at this point in his life is a fair one to posit. Bill Finley, however, reporter with New Jersey’s Thoroughbred Daily News — who, along with fellow reporter T.D. Thornton, broke the story of Frank and Elfriede’s lawsuit against Belinda and her children — says, “Do not underestimate Frank Stronach, and do not look at him as a typical 86-year-old. He is anything but. Frank is the healthiest, sharpest, most capable 86-year-old — with no signs of aging or slowing down. He has so much energy it is incredible. Frank is not a quitter; he thinks he has been wronged and he is not going to go down without a fight. This is his baby — his dream. He does not want it taken away from him, whether he is 86, 96 or 106.”

David Bentall, author of Leaving a Legacy: Navigating Family Businesses Succession (Castle Quay Books, 2012), shares in his book intimate insights around the challenges experienced in his family businesses, The Bentall Group and Dominion Construction (Bentall’s father was the developer of The Bentall Centre in downtown Vancouver), and the tipping points that can move family businesses from co-operation and cohesion to friction, division and enmity.

“Some of the tipping points that may trigger a generational rift include the common language we use when we think about family enterprises,” Bentall says. “Questions such as,‘When are you going to take over the family business?’ often set up unrealistic expectations and imply an abrupt change of control from one generation to the next, which in turn sets up unhealthy expectations on the part of the rising generation. Another challenge is that many entrepreneurial families don’t recognize the fundamental difference between sole ownership compared to shared ownership, where siblings are co-owners.”

Bentall’s grandfather, Charles Bentall, was Dominion Construction’s singular board member and sole owner. On his hospital bed, after a heart attack, he appointed Bentall’s father, Clark, as president of the family enterprise, transitioning the company into a shared ownership with Clark’s siblings. “Dad was successful in leading a much different business model than Granddad,” Bentall says. “But he didn’t realize he was running a fundamentally different enterprise — it was no longer a sole ownership. Dad thought that he was providing for his brothers rather than working for them.” And therein lies one of the key misunderstandings for the Bentall family’s future challenges.

At the heart of most family business conflicts, there is a lack of a formal, agreed-upon shared vision, a lack of an effective conflict strategy process and a resounding misunderstanding around succession expectations. Andrew Willis, business reporter for The Globe and Mail, has covered the Stronach family for over three decades. “The relationship between Frank and Belinda was good, right up until 2016,” Willis says. “They were soulmates, with a strong relationship both as father and daughter, as well as co-workers. However, in 2016, Belinda, concerned about the millions and millions of dollars that were being spent to fund her father’s latest ventures, said ‘No’ to Frank’s agricultural operations at Adena Farms — again, a venture that Frank envisioned would be his legacy. When Frank left Magna in the 1970s, he had a very difficult time walking away. He left the board and sold his shares; his reason for being was gone. So, he started looking for something else to do with his considerable energy.”

“The term considerable energy” is a descriptive that is used freely by both Finley and Willis to describe Frank. Being 86 years old is not a consideration for Frank. He is, and has always been, a serial entrepreneur, with passion projects that include a failed airline, a failed magazine, a failed energy drinks project and a failed restaurant/bar — the latter, interestingly, called Belinda. “Freudians would have a field day with Belinda’s relationship with Frank,” says Willis. “She is constantly trying to earn his respect by working in businesses that he is involved in. And I believe that is why Belinda got into politics — because Frank had.”

“I highly recommend that some type of formalized strategic planning/shared vision for the future is put in place, so that all generations are on the same page” — David Bentall

To Belinda’s credit, she has grown her father’s beloved horse-racing and entertainment enterprise, Magna Entertainment Corporation, from a $600-million business to a $1 billion business by bringing horse racing online and using it as content for gambling, as well as in casinos. “Belinda wants to conserve the family money for the horse racing and gambling business, but Frank wants to double down on the agricultural business,” Willis says.

But, as billionaires are known to do (think Donald Trump), there is the opportunity to go broke, a situation that is referred to as “liquidity issues” in Frank and Elfriede’s Oct. 1 lawsuit.

Certainly, there appears to be a gross misunderstanding as to what happened when Frank handed over the leadership of his company to Belinda in 2013, as a means of removing any conflict of interest in his run for parliament in his native Austria. It is posited that Belinda accepted the ground rules in advance — that all assets and businesses of TSG were attributable to Frank’s hard work and lengthy career — not hers — and that Frank held super trustee status, with the sole ability to appoint or remove whomever he wished from their positions of leadership and trust, including Belinda and her children.

But Finley has a different view on it. “Belinda just didn’t come in with a bulldozer and take over,” he says. “When Frank took off for Austria, he handed her the keys to the car and told her, ‘You’re running things now.’ Obviously, when Belinda was running the company, she, for that period, was in charge with Frank’s blessing. I guess, quite simply, she liked it. She probably enjoyed the challenge.”

Key to the misinterpretation as to who was in charge stems from the fact that when Frank returned from Austria in 2014, he just assumed that his role and title were reinstated; his lawsuit states that he was not informed that any additional steps of reinstatement needed to be taken. He further claims that it was not until 2016, when Belinda and Ossip stated that Frank did not have the authority to act in the name of TSG, and further in 2017, when Belinda stated that she would not recognize Frank’s reappointment as trustee of the 445 Trust, that the family structure imploded.

The Stronachs, of course, are not the only family business to collapse in such grand style. Abraham Reichmann, son of Ada and Ralph Reichmann, of Olympia Tile International Inc. fame, is suing his parents for the $40,000 monthly payments that he has become accustomed to receiving (from 1984-2012), and from which Ralph is attempting to cut him off.

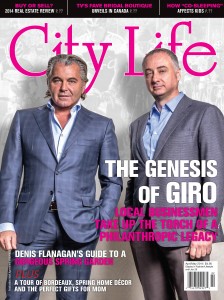

None of the allegations in either the Stronach or Reichmann family lawsuits have been proven in court. Also before the courts is a messy sibling feud between the three brothers and one sister of the Sorbara family, one of whom is Greg Sorbara, former Ontario Liberal MPP, 1985-95 and 2001-12. (Greg was minister of finance under the Dalton McGuinty regime in 2003.) Their father, Sam Sorbara, was the founder and patriarch of what would become the Sorbara Group, a multi-faceted real estate company, with current assets estimated at $1.4 billion. Joseph Sorbara, the eldest of the brothers, filed a lawsuit in 2016 against his brothers Greg and Edward, as well as his sister Marcella Tanzola, claiming that his siblings had engaged in conduct that was oppressive and prejudicial to the Sorbara company interests. With a lack of governance and no definitive business agreement between the brothers, succession is at the heart of the dispute. Joseph, 76, wanted his son, Paul, to succeed him as the co-CEO of the Sorbara Group. (Joseph and Edward served as co-CEOs from 1989 until 2015.) However, as Joseph’s application to the courts states, things devolved spectacularly when “Gregory, with Edward’s support, deliberately fired Paul without cause.” Joseph accuses Edward of making personal insults against him (while Joseph was ill in hospital), including the accusation that, “Edward emailed many Sorbara family members claiming Joseph had not done any meaningful work throughout his 30-plus years at the company.”

While Greg Sorbara declined a personal interview (as did Frank Stronach), he stated in an email, “I can simply tell you that the matters in dispute in our family relate primarily to succession planning and I am confident that they will be resolved within a reasonable period of time.”

With the considerable run of family rifts over the past few years, it is critically important for families to have not only clear understandings, but also formal, written agreements over processes, conflict resolution strategies and succession plans.

Ultimately, this goes back to Bentall’s core belief that lack of governance, the non-investment in conflict resolution mechanisms and consensus-building that can devolve into non-negotiable triggers are what can lead to friction and messy, highly public family-fling-fests. “Research confirms that there are three things that family companies can do to successfully transition from one generation to the next. One is to have a board of directors with a majority of independent members,” Bentall says. “This ensures that the right ideas are put forward and the right decisions are made. There is a much better chance of success when the family has regular meetings; issues can be discussed in a forum with facilitators present, so that a mechanism is in place before issues become unmanageable. The Stronach and Sorbara families might have been able to resolve their issues privately if they would have had these kinds of forums. And I highly recommend that some type of formalized strategic planning/shared vision for the future is put in place, so that all generations are on the same page.”

Bentall, who founded Next Step Advisors in order to share what he had gleaned from his 20 years working in his family business, states that in his own family, if, after going through the processes put in place to reach consensus, the partners could not agree on a path forward — if they couldn’t reach agreement — they do not go forward. The three dynamics that Bentall finds are true when assessing the generational semantics in a family business are: the elder generation always wants the next generation to succeed; the second generation always wants to succeed and show the elder generation that they can do as well as their elders; and, lastly, something which is often at the heart of the matter for so many family business misunderstandings: the older generation has the right to say when they are going to pass the reins to the next generation. In other words, it is the elder generation’s choice as to when they will move aside. “Unfortunately, successors often have an unrealistic expectation of when elders should hand over the reins,” Bentall says.

Regrettably, the divided Stronach family does not appear to be on this generational succession path. Andrew Stronach, in support of Frank and Elfriede, filed his own lawsuit on Nov. 1 against his sister, Belinda, Nicole and Frankie, and Alon Ossip. Willis predicts that the Stronach family will never speak again, and that Frank will die with no relationship with Belinda. “I am surprised with the harsh accusations that Frank levels at Belinda in the lawsuit,” Willis says. “He destroys Belinda’s reputation in his court documents; it is the saddest thing I have ever seen. Frank values his dream of an organic food company more than he values the relationship with his daughter,” he says.

“We see power struggles all the time within companies, but not with blood relatives,” adds Finley. “That is what makes it so compelling, but at the same time, sad. In the case of the Stronachs, it is father against daughter, which certainly puts a different element on it. What we should remember, though, is that we are only hearing one side of the dispute.”

The purpose and spirit of family businesses, ones created and established by family elders and relatives, are meant to embrace and function as a cohesive, supportive unit. The time-honoured tradition of families working together and operating on a platform of loyalty and trust, with elders nurturing the aspirations of young family members, are core values in family businesses. To witness the dissolution of a family, where the only answer becomes filing lawsuits and suing each other in the court of public opinion, is, sadly, a far cry from the original dreams and intents of most immigrants who come to Canada to make a better life for themselves, their families and the familial generations to come.

No Comment