Erin Lowry: I Like To Call Myself A Financial Translator

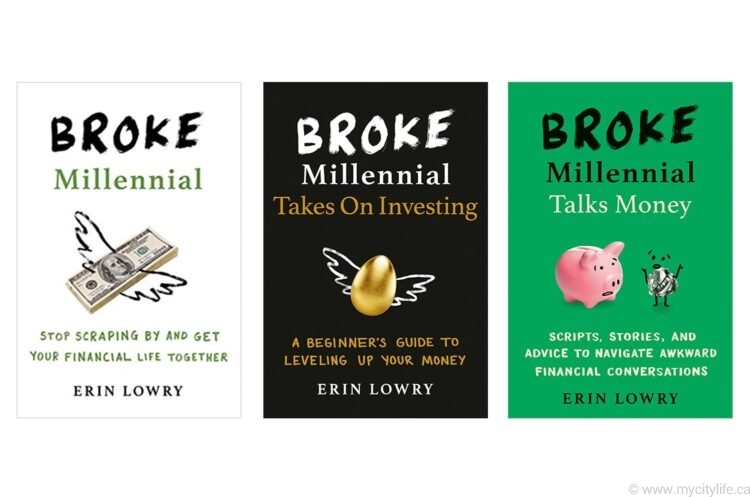

Through her Broke Millennial blog and three-part book series, Erin Lowry is on a mission to help millennials get their financial life together.

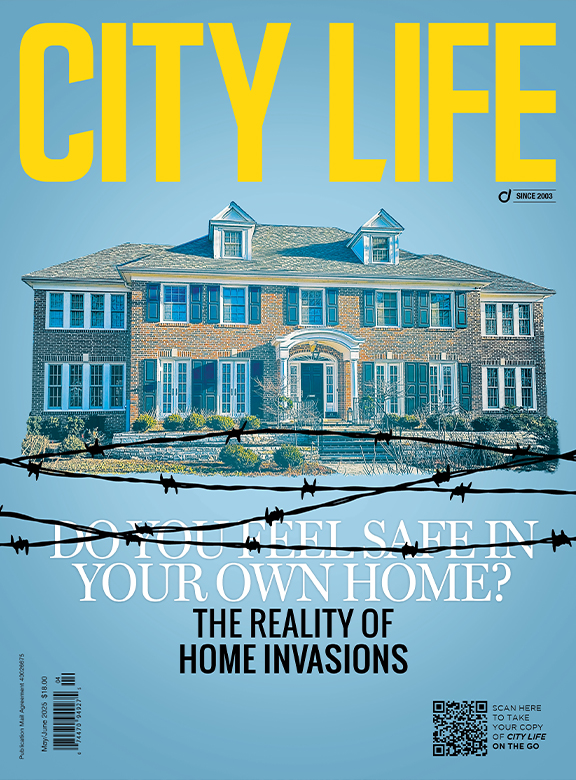

The art of flipping homes is a time-consuming venture and requires lots of TLC. Few people are able to bring out their true potential and gain a return on their investment.

Talking about money is tough. Writer, speaker and personal finance expert Erin Lowry knows that, but believes it doesn’t have to be that way.

“My parents raised me in an environment where talking about money was normal, so I thought everybody was comfortable doing it,” she says. “I moved to New York City after college and it became quickly apparent that a lot of people found it awkward and uncomfortable.”

For Lowry, these tensions can come from a variety of places, including the way you were raised, social situations or your own lived experiences. “Student loans in the U.S. are a very common talking point,” she says, offering an example. “That then bleeds into other conversations like not making as much money as friends.

“It also goes into things like dating. Am I comfortable dating someone with debt and how do I have that conversation? How do I tell someone I’m financially responsible for my parents? Money impacts every single element of our lives and social dynamics, but we often never directly say that.”

Finding that dynamic “fascinating,” Lowry decided to do something about it and push herself to create a space where she could talk about money openly. The answer? Broke Millennial, a blog-turned-book that offers lessons that cut through the noise of personal finance and help people navigate their anxieties and uncertainties when it comes to cash.

While her advice is relevant for every generation, it’s a pivotal moment for millennials, who are at a time when weddings, engagements and seeing friends purchase properties is commonplace.

“So often the rhetoric is about cutting the lattes and avocado toast. That’s not the financial problem,” she shares. “It’s birthday dinners, bachelorette parties, wedding invites. Sure, little things can bleed you dry over time, but what’s going to really bleed you dry is not being able to set boundaries around your money, and not being able to say no.”

The Broke Millennial book series is split across three volumes covering different topics. Where the first offers a step-by-step guide to reworking your finances, the second book gives a from the-ground-up look at investing. The third is more emotional, offering real scripts and stories to navigate tough money conversations with friends, family, colleagues and loved ones.

“I like to call myself a financial translator because I’ve never worked in banking or in an investment firm,” Lowry says. “I don’t have an economic or finance background, but I do like to ask questions and tell stories. So, the books aren’t written from the perspective of me being the expert, but rather talking to experienced, smart people and translating their slightly complicated jargon into something that’s easier to understand.”

“I don’t have an economic or finance background, but I do like to ask questions and tell stories”

The storytelling has paid off. As well as sharing stories of people who’ve reached out saying the books helped them feel confident with investing or understanding how to pay off debt, she’s also realized glaring issues with current financial advice. She compares it to the world of fitness, believing advice should be more empathetic and compassionate rather than chastising people for making different choices.

“Part of it is understanding your emotional relationship to money,” she says. “Are you buying things you don’t want or need because you get a dopamine rush and it’s creating a cycle for you? If so, I wouldn’t say that’s bad, but I will say let’s analyze what emotions are triggering that cycle and what we can do to work on those emotions. It’s about bringing more psychology into the money conversation.”

Above all, Lowry wants people to recognize what they value, save, invest and spend in a way that aligns with those, and say no to everything else. “I think of success as living a life in accordance with what you value and spending lavishly on those. I don’t just mean money but also with time, brainpower and emotionally. I think for so many of us it’s hard to figure out what we actually value — and being open to the fact that those things change over time.”

brokemillennial.com

@brokemillennialblog

INTERVIEW BY ESTELLE ZENTIL