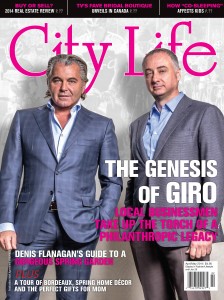

Busy Work/Lifestyle: Have You Considered Hiring a Portfolio Manager?

Find your trusted advisor in Jason Polsinelli as he shares his insights about portfolio managers.

Jason Polsinelli of the Polsinelli Financial Advisory Group leads a premier financial planning, advisory and wealth management team at Scotia Wealth Management. He hopes to use his unrivalled experience and expertise in this industry to help you manage your financial needs.

Q. There are a lot of titles out there for those who look after wealth. How can I tell which one is best for our family’s wealth?

A. In the past there were a number of titles and available choices, making it difficult for investors to ascertain and select the best fi t when it came to a trusted advisor. The industry has done its best in the past few years to provide better clarity and narrow them down but nonetheless it can still appear to be a bit confusing or overwhelming. When it comes to choosing an advisor, it is better for an investor to frame their choice based first on how involved they want to be in the day-to-day investment decisions for their portfolio.

Q. What are those levels of involvement investors choose for their portfolios?

A. Of course, individual investors are unique and will often choose different involvement levels and specific advisors for different portfolios or accounts. Some investors want full control and decision-making ability as they remain active in the choosing of their individual investments. These individuals prefer self-directed platforms where they are essentially their own advisor. Other investors prefer the comfort of an advisor but would like the ultimate decision on all the choices made for their portfolio. However, a growing segment of investors are choosing less active involvement and prefer to hire a portfolio manager to make all decisions within a prescribed framework to which they both agree in advance.

Q. What is the difference between an investment advisor and portfolio manager?

A. On the surface it may not look much different but there are significant differences between these two roles. Portfolio managers are required to have specific accreditation and must have first apprenticed as an associate for a certain length of time before receiving their designation. They are bestowed with much more responsibility and care in managing a client’s wealth.

A client gives them the discretion to choose and manage the individual investments within their portfolio on their behalf. Therefore it is incumbent upon the portfolio manager to ensure they are aligned and aware of the investor’s needs and objectives. Because of the ability to exercise trading discretion on behalf of clients, there is a higher level of duty of care to make sure client expectations are determined and met.

The investor–portfolio manager relationship is managed by way of an Investment Policy Statement whereby all objectives and expectations are determined in advance. Once the IPS is agreed upon and signed, the portfolio manager is mandated to stay within those parameters and objectives.

Q. What type of investor chooses a portfolio manager versus the other options?

A. There can be many reasons for making this choice but most of the time clients choose this type of service because they have really busy lives and may not have the time to make day-to-day investment decisions. They also recognize the amount of expertise required in building and maintaining portfolios and prefer to rely on this expertise to help them achieve their goals.

For more information, contact the team at

905-695-1518, or visit:

polsinellifinancialadvisorygroup.com

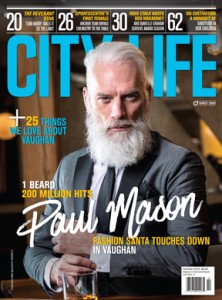

No Comment