The Cost of Driving

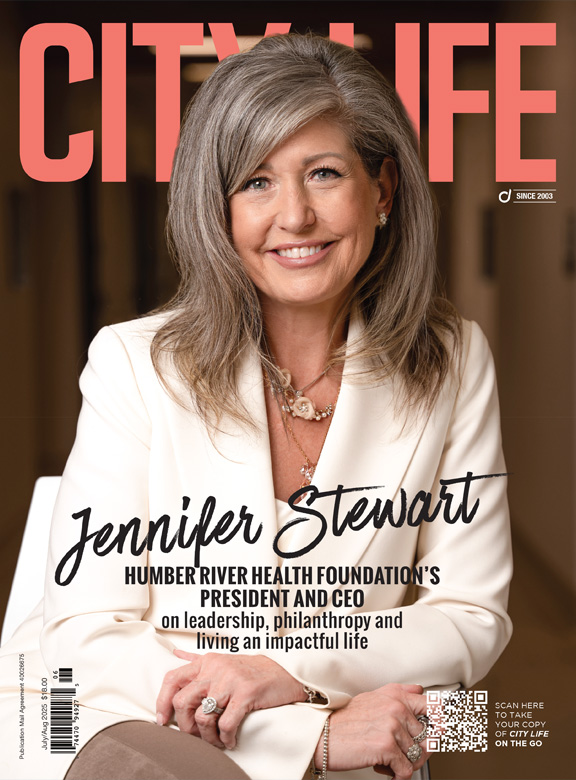

Buckle up, Vaughan — a new research study reveals just how high our car insurance premiums are

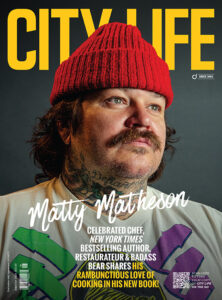

With warmer weather rushing in and gas prices still relatively low, driving to work every day and hitting the highway for a weekend road trip is inevitable. But one should take heed before packing up the kids and preparing snacks to go: new research from Canada’s first online insurance marketplace sees Vaughan and Woodbridge tied for the second spot of a top 10 list showcasing the most expensive car insurance premiums in the Greater Toronto Area.

According to the release of a recent Kanetix.ca research study, Ontario has the highest auto insurance rates in the country, with premiums varying significantly across the province and noticeably spiking in the Greater Toronto Area. Brampton tops the list at $2,393, followed closely by Woodbridge and Vaughan, where citizens are paying 41 per cent above the provincial average of $1,538 a year in car insurance. Compare that to Belleville and Kingston, Cobourg and Napanee — Ontario’s more economical cities for car insurance, with the latter two averaging $1,014 per annum — and that bicycle buried deep in your garage may look more appealing now than ever.

“Insurers set their premiums based on claims and actuarial data from a given region. These areas had the highest incidence of claims so this is reflected in the premiums,” explained Janine White in various news sources upon the release of the study. The vice-president of marketplaces for Kanetix.ca also added that “urban areas tend to have higher insurance rates because there are more cars on the road, higher frequency of accidents and greater severity.”

Car insurance premiums in the GTA

Providing over a million insurance and comparison quotes to consumers every year, online insurance marketplace Kanetix.ca’s recent research study revealed just how costly car insurance premiums are in the GTA

Kanetix.ca’s tips to lower your insurance premium include maintaining a clean driving record and combining auto and home insurance policies to save up to 15 per cent each year

No Comment