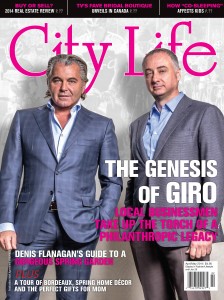

Corporate estate preservation: Q&A with Sugi and Geoff

Increase the size of your estate by moving surplus corporate dollars into a tax-exempt life insurance strategy.

What is it?

A strategy of moving surplus corporate capital (savings) from a taxable investment into a tax-exempt, corporately owned policy to greatly reduce tax owed and enhance what you are able to leave to heirs, or charity.

Who is it for?

Individuals who own a private corporation with surplus capital in taxable investments. The corporate estate preservation strategy allows you to use some of your business’s existing passive corporate assets to fund a tax-exempt life insurance contract. The death benefit enhances the value of your corporation, which you can then pass on to your family and/or charities in a tax-efficient manner.

This strategy is best suited for those who:

• Are individuals 45 years of age or older and in good health.

• Are a major shareholder of a private corporation with surplus capital (savings) not required to operate your business or for retirement needs.

• Want to preserve capital for your family and/or charity and enhance the value of your estate.

• Seek cost-effective strategies to distribute the corporation’s locked- in surplus to shareholders.

• Have a holding company that is looking to grow corporate surplus in a tax-advantaged environment.

How does it work?

The corporation purchases a tax-exempt life insurance contract, typically insuring the life of the primary shareholder. There is no annual taxation on the capital deposited into the policy, and on the death of the insured the death benefit is paid tax-free to the corporation. All or substantially all of the death-benefit proceeds passes tax-free to the intended beneficiaries as a capital dividend either directly, or indirectly through a trust or estate. Through the use of this strategy, corporate capital is tax-sheltered and then paid out of the corporation tax-free.

For more information on this topic, please contact Sugithan Kumaresan, CFP, CIM, Senior Wealth Advisor, CIBC Private Wealth, Wood Gundy

4110 Yonge Street Suite 600 Toronto Ont.

416-229-5866

sugikumaresan.com

@cibc

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc. Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors. Sugi Kumaresan, CFP, CIM is a life insurance-licensed advisor with CIBC Wood Gundy Financial Services Inc. The views of Sugi Kumaresan do not necessarily reflect those of the insurance agency. Geoff Booth, CFP, CLU, CHS, CEA is a life insurance-licensed advisor with CIBC Wood Gundy Financial Services Inc. The views of Geoff Booth do not necessarily reflect those of the insurance agency. Insurance services are available through CIBC Wood Gundy Financial Services Inc. In Quebec, insurance services are available through CIBC Wood Gundy Financial Services (Quebec) Inc.